John C. Reece was the IRS CIO from March 2001 to April 2003. In the July 18th issue of Federal Computer Week, he proposed a tax system implemented as a Web-based solution that would collect federal taxes in much the same manner that sales taxes are collected – that is, as part of each transaction in which federal income taxes are payable. Collection transactions are posted to my record, and I just have to log in once a year, update info, and “balance the checkbook”, sort of speak.

Optimization

This is representative of a larger trend I’ve observed that bothers me. I first saw it at the United States Post Office, where I used to be able to ask what the fee schedule is for mailing things under different categories. I ask this information because it’s the immediate cause and necessary information for me to make a smart decision about my action, specifically how I’ll ship a package.

Times have changed. The methods, rules, or algorithms that define shipping services, return receipts, insurance, registration, and delivery times are no longer available. Instead, the textbook answer is “bring me the package, I’ll put it on the scale, and tell you your options.”

Sadly, this methods serve you, not me. Once the package is on the scale, your computer defines your options to accept the package. But you’ve deprived me of information to analyze my options. Your methods work if I’ve already committed to shipping with you. But maybe I want to go with UPS. In which case, USPS requires brown wrapping over marked boxes, and no strings. UPS refuses packages wrapped in brown paper, but will accept tie wrapped items. UPS gives $100 insurance free. USPS doesn’t. And so on.

I want to optimize my decisions before I commit. Because you no longer release algorithms and relationship information, I can’t. You insist on processing me as a serial stream of events – batch processed, with no mid-stream corrections.

Reading Mr. Reece’s article made me realize this is an even more potent and onerous change in the realm of federal taxation. In a manner similar to the UPS interaction, the user is deprived of any comparative analysis. “Tell us who you are, and your situation, and we’ll tell you the required tax.” This is NOT enough for my decisions of how to live a life! You have satisfied your agency needs, but deprived me of an important aspect of what the traditional partnership has been. I need to know how you do it, so I can optimize my choices to optimize what I value (in this case, it’s how much money I have to give up).

In fact, the depth of importance of knowing the algorithms is witnessed to by the fact that a normal person spends hundreds of dollars on tax filing services, let alone anybody considering estate or retirement planning. BIG dollars are spent customizing (more specifically, numerically optimizing) each person’s interaction with the IRS because they value the outcome. If you deprive people of their valued outcome, the method, by definition, is a failure.

Even with web-based IRS accounts for each individual, I’m sure somewhere in the National record, a person will still be able to extract a description of how the taxes are calculated, but this will NOT be lucid.

For example, the FASFA form is a step by step IRS-like form. But nowhere will you find the core truth that, once past the low-income deductibles, expected family college contribution is 5.6% (check) of any savings and investments, and a full 48% of any income cash flow. Balance this with a combined marginal federal, state, city, social security, Medicare, and sales taxation of over 50%, and you’ll see why families hurt with kids in college. Loans are inevitable. But the batch processed forms and web-field entry calculators don’t reveal this without dedicated and knowledgeable analysis. I’ll guarantee you most college administrator have never realized the content of this paragraph.

Errors

Even if you do have the intrepid character to tear into all the foundational regulations and laws (or finances to hire someone else to do it), here is a scary societal issue: when they differ, the batch processing web page will be taken as truth. What it says is “how much you owe”, regardless of what the original regulations say.

Don’t believe me?

I was in this type of trap in the realm of estate gifts to minors. There is a concept of “future interest” that is well defined in the tax laws, but somewhere it got misread, and propagated through the financial industry.

I was in this type of trap in the realm of comm-out procedures for military pilots who have been given a heading to fly by the ground-based air traffic controllers. An initial mis-reading was promulgated through years of publication of the Flight Information Handbook used by USAF pilot training.

I was in this type of trap with the USAF Reserve payroll system, when they blurred the distinction between “commuting areas” and “local areas”.

In all cases, it took months of effort to reconcile the executing arm of the supposed rule with the original source. With the finance issue, it took written correspondence with three IRS auditors (Three because what any employee says means nothing legally, so I figured if I got the same answer 3 independent times, chances were good it was right), and the legal department of a national investment firm. With the pilot issue, it took multiple letters to the military publications office, highlighting the FAA regulations that were misunderstood. With the pay issue I had to escalate the issue to the office of the commander at both the Reserve personnel center and the local base I was stationed at before the change was made.

The point is that once the batch process is entrenched, it becomes the truth. You have to dive very deep into a political environment of personalities, job responsibilities, and organizational relationships to ever re-connect people to the real truth. And in the process, it’s your butt on the line, your finances, and your life that is spent fixing the situation.

Implications

Your identity is the database record. Ask someone who’s been through an identify theft experience what it takes to prove you’re someone other than what the computers say you are. My observation is that you are allowed or defined to exist by existence of a birth certificate. You prove identity as an American by virtue of the same paper, or perhaps an alternate such as naturalization forms. In either case, these prove that you exist as part of the United States. A second part of your identity, how you exist, consists of all that you have been. Past tense is important here. Whether it’s a signature on a credit card or biometric security access via retina scanning, all the technology is in place to connect the flesh and bones at a given location and time to a known history previously exhibited by that same flesh and bones. Most pointedly, it does nothing to establish who you are. It establishes who you have been.

A socially visible example are the web-published sex offender data bases. Based on the concept of forgiveness, I could make a could make a case that there are times to “forget” the past. The Bible clearly says that God, at times, “does not remember” historical sins. Yet when the computer databases own the truth, and they analyze only history, you are who you have ever been.

In a technical sense, the technology used to implement the sex offender data bases prevented some reverse lookup capability that should have prevented vigilante behavior or loss of local real-estate values. That was before another entrepreneur bound the database to the Google.com mapping capability. The combination of interpreting historical numbers as a prediction of future events is a natural and prevalent trend. And it is creating all sorts of unforeseen problems. To whit, some city police forces are now taking heat for biasing police patrol activity (shown on the maps) away from the major gang criminal activity (also shown on the maps). Wonder why? Even police like to go home alive at the end of the day. If you allow yourself to engage on observations like this, it quickly makes you ponder the purpose of a police force.

Socialization of responsibility

The proposed tax system levies the legal requirement of tax collection on entities less flighty than an individual. It’s true that larger partnerships tend to be more compliant. For example, the military knows this and implements a two-person concept on certain highly classified accesses or activities. No one person is ever given unmonitored access. For instance, nobody drives around by themselves with nuclear weapons. No pilot has ever flown with a nuclear bomb, with full release capability alone. In the financial realm, the IRS knows that companies tend to respond better and be more compliant because they’re easier to drag into court – more accurately, that they have more to loose if they don’t show up in court, and they’re easier to find. If the collection effort is levied on a company, there will be tremendously less hassle and loose ends.

And in a fully socialized society where you’re defined by, and processed by computer batch programs, my friend, you (the individual), are a loose end.

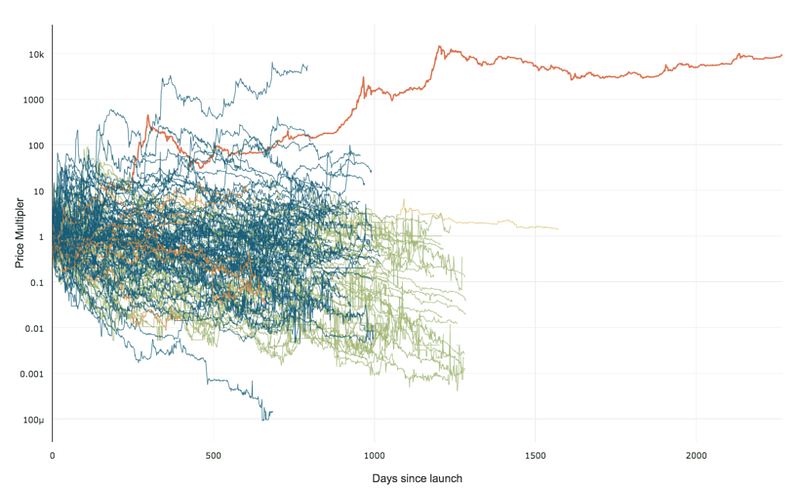

99% of ICOs Will Fail

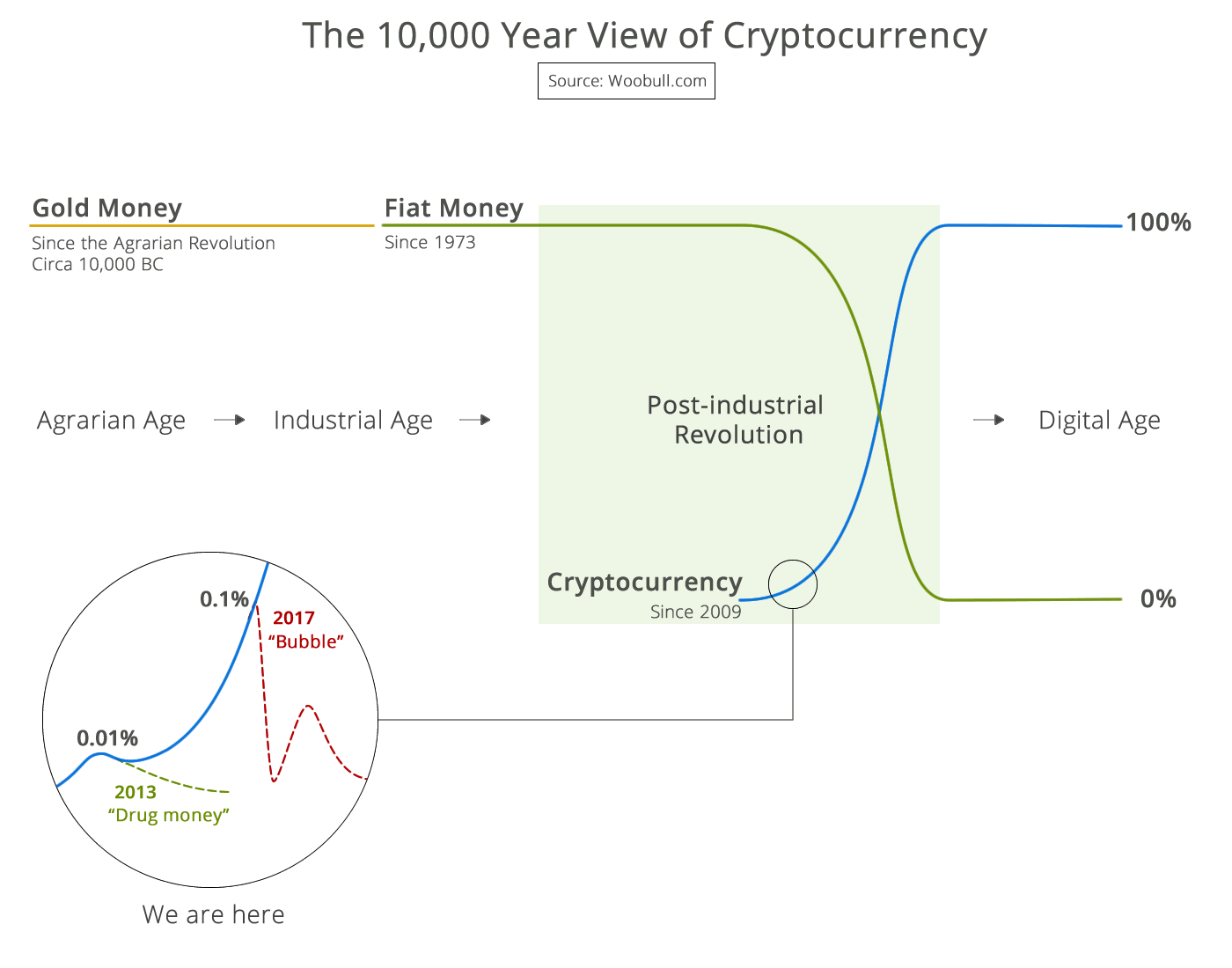

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency