The IRS is coming for you. The $600 reporting rule was pushed through by our Federal government’s administration.

It used to be that you had to receive $20,000 and at least 200 transactions to incite bank reporting to the IRS. Now the threshold is an aggregate of $600 over the year in any number of transactions. [Update: apparently the rule has been pushed out to 2024 tax year and $5000 because it would have otherwise been unexpected and incurred tax for lower income folks that don’t otherwise have a tax obligation.]

What causes me angst is that the *other* person (sending the payment) designates whether the payment counts or doesn’t count. Paypal is clear that there is no process to fix a mistaken designation.

“PayPal tax reporting is required when the sender identifies the product as goods and services to the IRS, even if it was a mistake.”

In other words, based on what a disinterested and sometimes confused sender clicks on their computer, a recipient has to pay taxes on the transaction amount, unless the recipient proves it’s deductible. What happens if a sender wants a refund? Don’t even step into that mess of paperwork. And remember, this is income tax. In addition, the money recipient may is probably also required to submit sales tax to a more local authority.

Let’s add it up. Probably 24% Federal income, maybe 5% State income, and maybe 5% Sales tax. It’s easy to reach the point where 1/3 of money received needs to be sent away as taxes. If you sell your old car for $3000, you get to keep $2000, unless you research, assemble, and store records proving you paid more than $3000 years ago. Do you even know how to deduct the basis of non-business personal property? Be sure to include the cost of paying someone to do all the tax calculations and form filling to track the basis of any personal non-business assets. When did you last do an itemized deductions Schedule A? Did you meet the 10% threshold? Or is it a 2% threshold?

The IRS says:

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital Assets, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and Losses.

Remember the garage sale you did, and took an an electronic payment method? Yup, you’re paying taxes on that, too unless you tracked every sale and kept records proving the costs basis of each items you sold. What did that garage sale coffee maker cost that you purchased at WalMart 8 years ago? Bob’s old boots? You kept receipts, correct? Naturally, thermal printed receipts fade after 6 month, so did you scan them into your computer and archive them on a hard drive somewhere?

This is nuts.

This has created a commune collective burden. The government deputizes everybody else to create work and admin burden that takes my life and there’s no way out. Same thing as when the government deputized Facebook or Twitter to censor conservative views that were illegal for them to censor: it wasn’t the government doing it, per se, they just mandate that other people do their will against the target. When all forms of productivity have been administratively burdened into oblivion by government deputies, then we’ll all need the government to rescue us with some additional program. The quagmire just feeds itself.

Looks like I’m going to have to wean myself off from digital money transfer. I want to avoid the annoying paperwork mandated by a stratus of people who want to dominate every $1 issue of my life while there are $100 other problems they should be fixing.

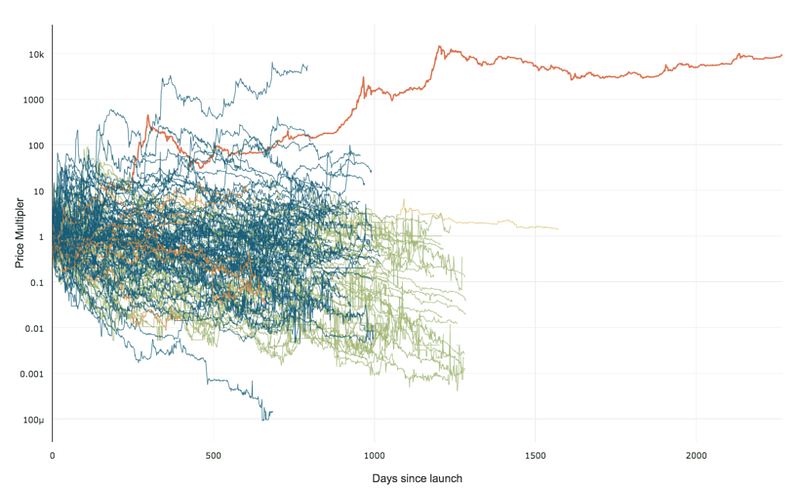

99% of ICOs Will Fail

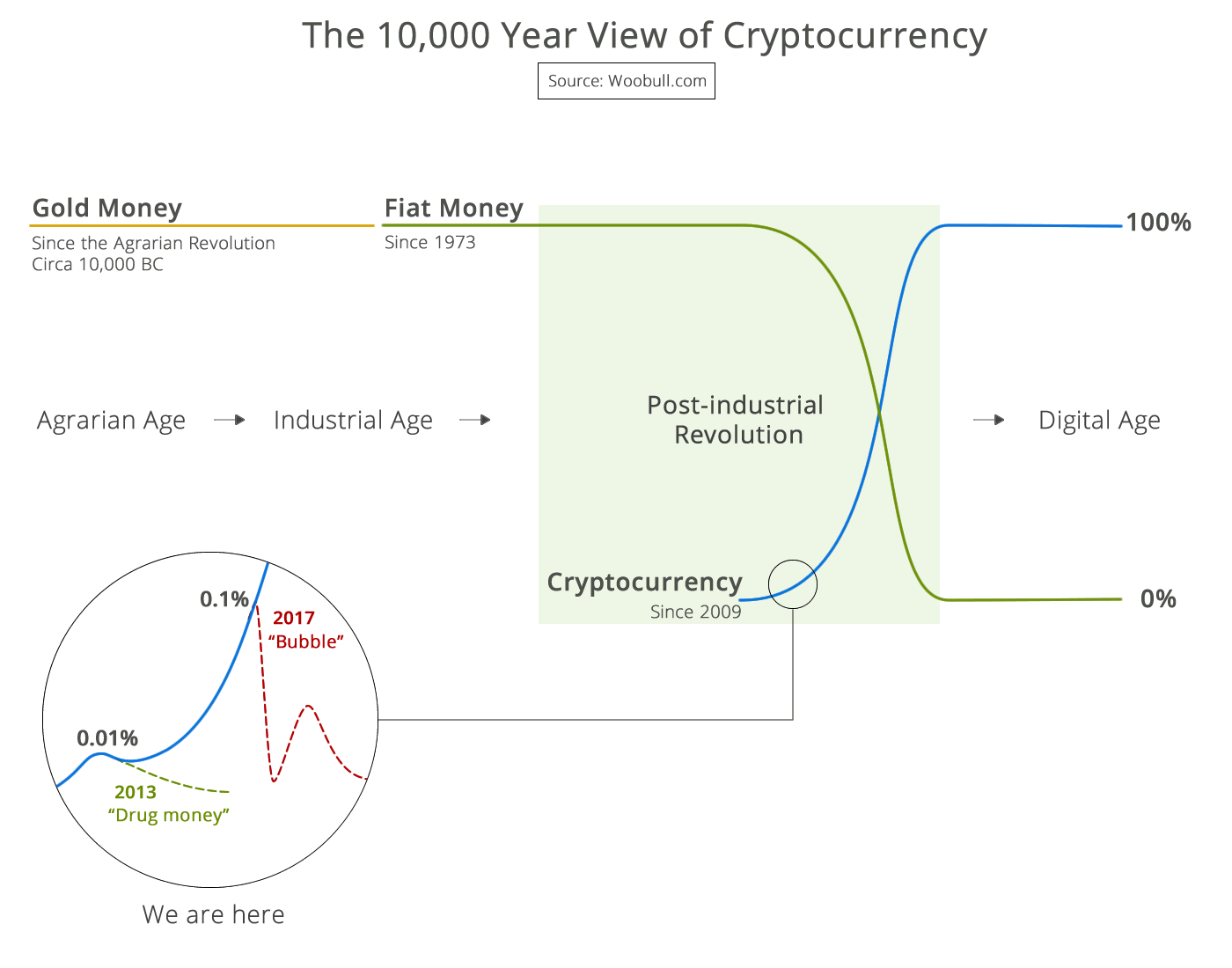

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency