My prior post basically talked of reduced supply and deflationary pressures. Yes, we can chop up bitcoin and give the pieces new names. IMHO, that’s a word game. Nonetheless, it does highlight some innate character of cryptocurriences. I don’t think any force will stop cyrptocurrencies. I think realities of how they operate will slowly change them to become something other than what they started out as.

To an engineer, Satoshis are BTC * 10^-8, nothing more. Other coins have other “named” fractions, too. Long before cryptocash, the financial industry had “percentage” and then “points” when the percentages got too small. I think giving it a name doesn’t change the numbers except in people’s psychology.

Regarding “lost coins” maybe that’s only a topic of discussion because it can be quantified with the new technology. I mean, how many bars of gold are lost sitting in some pirate hiding place or at the bottom of the ocean? We just never counted that part before. Now we can, so we talk about it.

Besides named fractions, forking is the other technology brought up with the effect of creating more things to trade. True, but the dominant character of forking is in a different category – like hot wallets. Let me explain. First of all forking is really no different than a stock split, so it’s not such a big deal in as much as it behaves like it’s designed. That maybe is the minor point with a long history in stocks. Something else about forking is the dominant crypto issue, and in that way it’s like hot wallets.

Bitcoin was created to be independently operated, a non-centralized operation. This character WAS Bitcoin, well implemented, but not perfectly due to technology limits. What’s happening as Bitcoin gets more popular is it’s destroying its own character. Independence is being given away for cultural convenience. Just like the Pilgrims wanted to be independent, they went and did so in America until it became convenient to start clumping together into cities and states. And the freedoms they were after have been slowly subsumed into the reality of running a new society / culture.

Instead of everybody having desktop or paper wallets, disconnected from the rest of the network, the vast majority of Bitcoin is now being held by secondary parties – Gemini, Coinbase, Kraken, etc. Centralized, dominant, regulated entities that are starting to look a lot like banks, which are anathema to the original character of Bitcoin. It’s convenient for casual users, who just want a web page log-in to access their value and couldn’t care less about (nor care and protect) private and public keys. And here’s my thought: as long as Bitcoin stays “pure” to it’s technical independent ways, it will not expand or succeed. As long as Bitcoin gives up part of it’s original character into centralized monetary repositories – regulated by the states and the nations – only THEN will it expand into large sections of society. In short: to become more, Bitcoin must give up what it was designed to be.

Forking is another example of groups, committees, consensus, necessarily supplanting individuals, diluting the original character of cryptocurrencies. Without forking, Bitcoin suffers under deflationary pressures. So there “must” become committees, groups, consortiums, who together decide to issue Bitcoin Cash and Ethereum 2.0, etc. Again, the (supposed) independent nature of cryptocash must give up some of it’s own character in order to survive in the realities of acceptance and culture.

Lastly, even crypto currency mining is being concentrated in fewer and fewer data centers that can afford the KWH/token payout ratio. Although I think the transition of mining from Proof of Work to Proof of Stake is primarily about saving energy, I think it’s also an attempt to get back to Bitcoin roots of nobody owning too much of the node network.

Here is a much more complete and thought-out academic treatise on what I’m trying to say: Synonymous with wider acceptance, Bitcoin is betraying its original ideals.

Pragmatically, I think Covid has driven people indoors for too long. They have had nothing to do but stare at computer screens, so cryptocurrency is on a hot rise in value, just like it did end of 2017. And yes, the crypto community has greatly matured since the end of 2017. When everybody is done with Covid and starts spending life outdoors again, the price will fall and that’s when I think I’ll buy in. I almost bought a bitcoin end of 2017 for $900. It would be worth about $55,000 now. $43,280 after 15% long term gains tax and state tax. Maybe on the next “dip and climb” I’ll buy and benefit. Third time is a charm?

Ecclesiastes 1:9, written by one of the most respected wise men of the Earth, says “What has been will be again, and what has been done will be done again.”

- Federal Reserve targets 2% inflation, and Bitcoin committees do the same thing with forking.

- Centralized Banking is regulated under government control, and Bitcoin has centralized hot wallets and exchanges, under government mandates.

- Merchants consolidate Proof of Work mining centers.

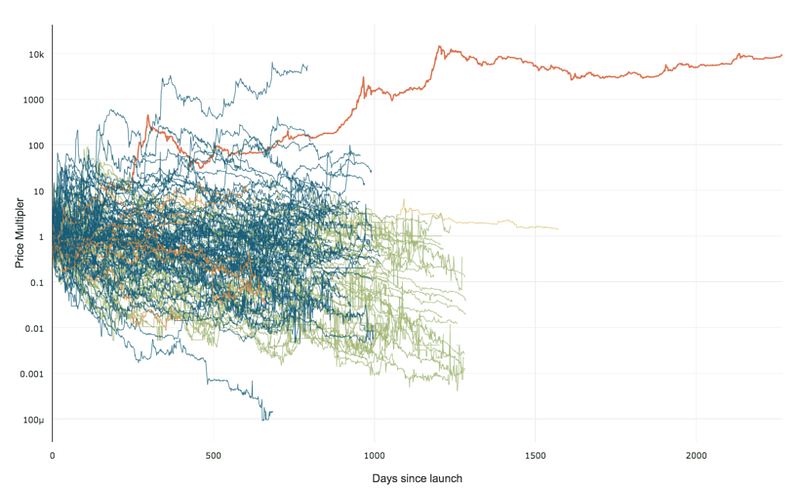

99% of ICOs Will Fail

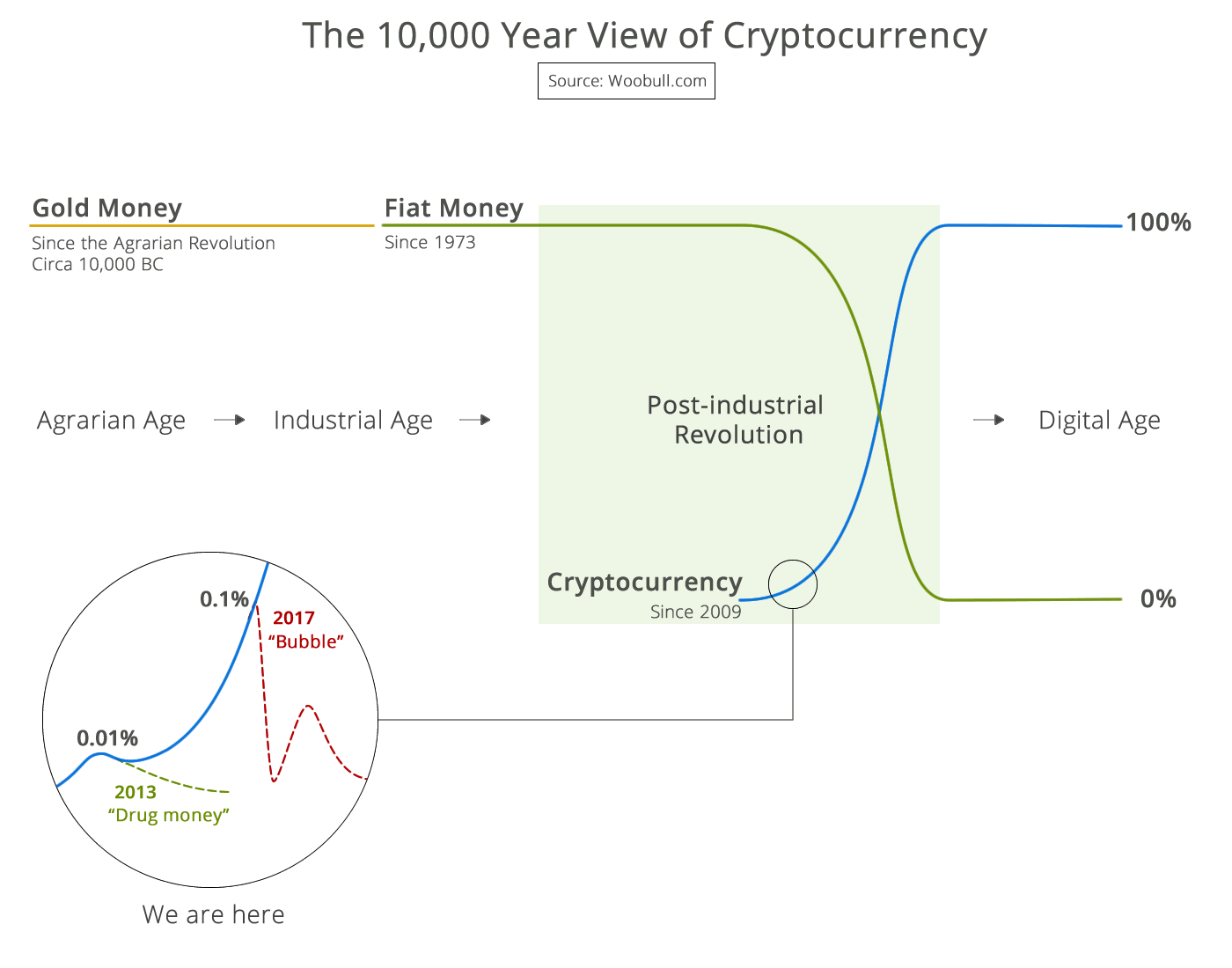

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency