The Federal government has announced a significant overhaul of the military retirement system to make it more like civilian plans with some defined benefit and some defined contribution. It is called the BLENDED RETIREMENT SYSTEM, or BRS. Division of military retirement upon divorce tends to be a contentious area of law. I expect each portion of the new retirement will be handled separately in divorce cases.

If you join the military after 1/1/2018, BRS will be mandatory. If you join after 1/1/2016, it is optional. Before 1/1/2016, you stay with the old system. I imagine divorce cases with BRS will start to appear some time in 2017. Here are how the three portions should be divided:

TSP employee contributions and employer contributions are a defined benefit plan. At the time of divorce, the existing balance will be divided between the parties. Contributions and employee matching after the time of divorce will be the sole property of the military member. Typical valuations can range from a few thousands of dollars to over $100,000 depending on how much was saved in the account prior to divorce.

CONTINUATION PAY is a lump sum at the 12 year point if they opt to stay in for 4 more years. The amount will be 2.5x monthly pay for an Active Duty Officer and 1/2x monthly basic pay for a Reserve Officer. This translates to about $28,000 for rank less than General down to almost nothing based on 2016 pay tables. The benefit is “earned and accrued” during the 48 months after it’s paid. During this time, the amount of division should be prorated. If the divorce occurs at the 12 year point, none of it has yet been earned (even though it’s been paid) so it should be divided 100% to the military member. After 24 months, half of it is a marital asset (and should be divided). After 48 months, all of it is a marital asset.

RETIREMENT ANNUITY is essentially the same as the prior retirement system, except the multiplier is 2% instead of 2.5%. All the same division languages can be used because this change affects only the gross retirement amount. Each party still gets whatever percentage of it they would have gotten before. The only difference is much of the value can be taken as a lump sum at the beginning of retirement, yielding smaller monthly retirement checks 25% or 50% of what they would have been. The monthly retirement checks bump back up to full value at age 67.

The lump sum, if it was taken before or after the divorce, will need to be divided using the same DFAS percentage that is used to divide monthly retirement checks. This could be a problem if the couple already “spent” the money — it’s nigh impossible to determine if the lump sum is still resident in the estate or has been mutually dissipated, and each party will have opposing propensities.

USFSPA mandates that a military member cannot be forced to give up more than half of retirement pay to all ex-spouses combined (as an asset; child support or spousal support is another thing). Often times, the ex-spouse portion is smaller because of coverture fractions.

This means a military member will want to claim the retirement lump sum is still wholly “in the bank” because that amount will be divided less to the spouse. The ex-spouse will always want to claim that the retirement lump sum was dissipated (on an ocean cruise or some other non-capital expenditure), so that the entire estate is divided 50:50.

If the lump sum was quarantined and traceable, it can be divided with its own percentage. If it was rolled into a capital asset such as paying off a home mortgage, the amount would have to be corrected based on how the asset has gone up or down in value. Other destinations of the lump sum would be a lot harder to untangle.

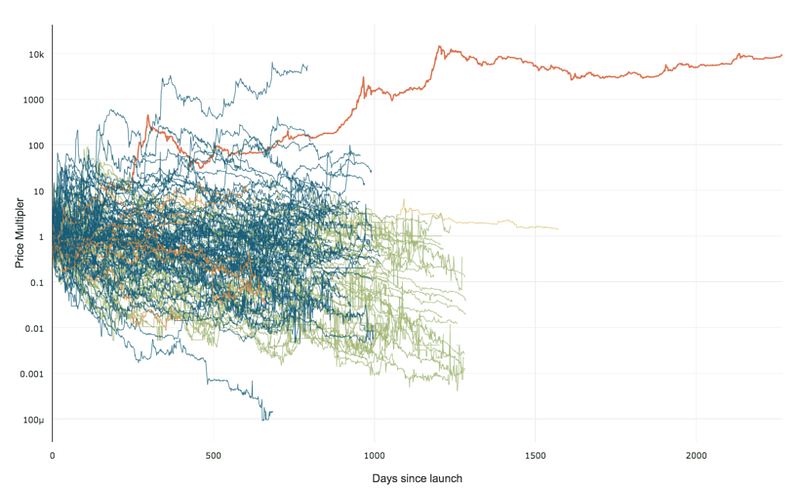

99% of ICOs Will Fail

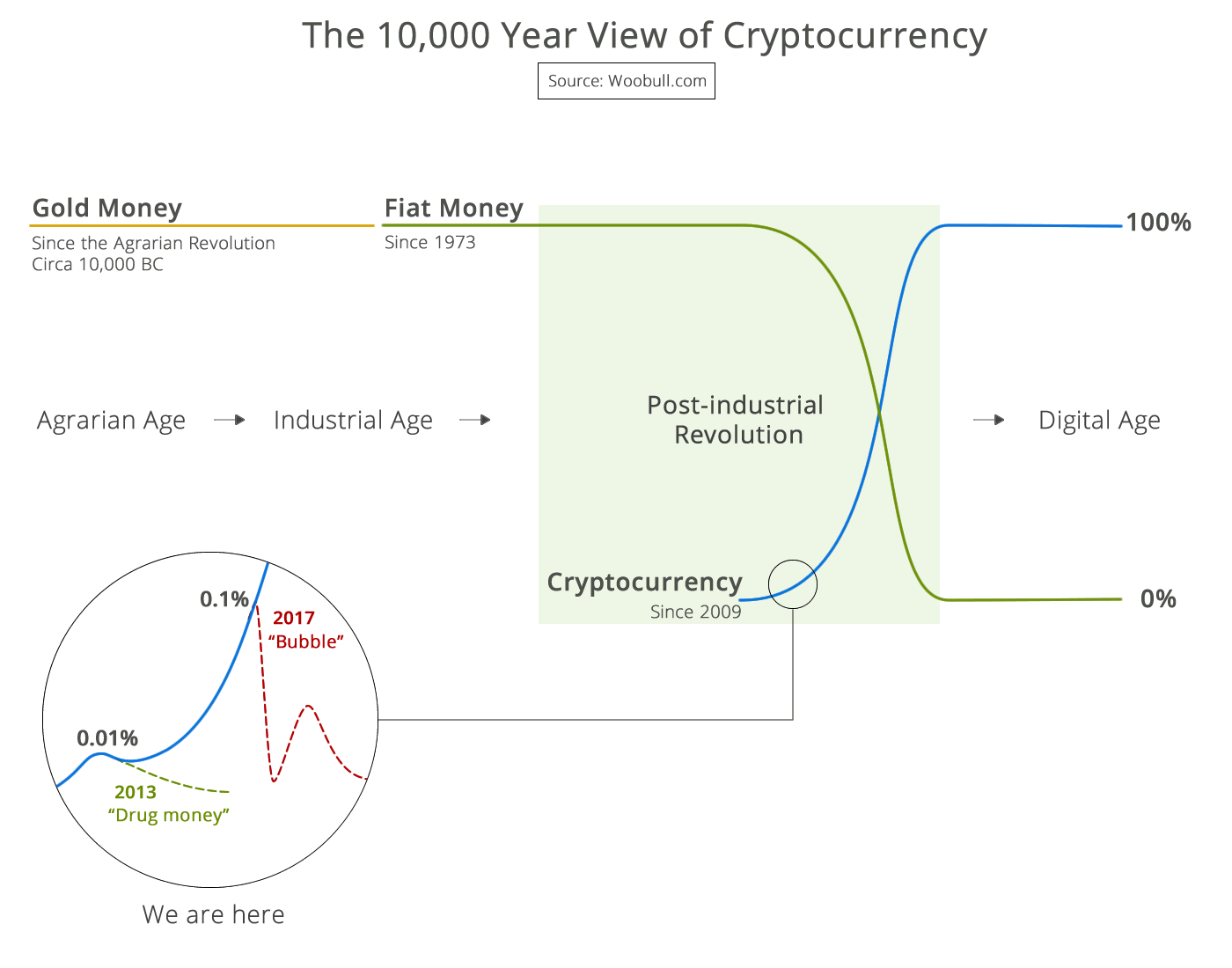

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency