I had an hour to read the 30 July issue of the Wall Street Journal today. I know what I’m going to say isn’t a popular position, but I’ve decided it’s time that our nation should be confronted with default.

Our leaders should be forced to spend money not to exceed what they have coming in. We won’t default on what we owe, but we’ll definitely have to stop spending in a lot of other areas. The two significant “debt recovery” plans going around Washington these days are weak. At the rate of recovery proposed, it will take 150 years close the deficit gap. Although your parents allowed our society to get so far into debt you don’t know what to do, perhaps you will leave something better for your children.

I’ve decided that we’ve become too much a pampered nation of getting everything we want. A lot of the articles I read had to do with unemployment catastrophe that has settled over America. One article after the other left me with the impression that we’re doing it to ourselves.

- “I’m totally discouraged,” says T.G., 53. After eight months of unemployment, she took a job as a $150,000-a-year manager of product development for a large retailer in Boston. Now she commutes across country because she can’t sell the home where her children are still living. She pays roughly $4,000 a month between mortgage, upkeep, and rent in Boston.” If net income is about 2/3 of gross income, that still leaves an extra $50,000 per year extra; what’s the problem?

- “Trussbilt LLC, which makes security products for correctional facilities, says it can’t get workers to come to Huron, S.D., where the firm has manufacturing facilities and the unemployment rate is less than 5%.” Take the job. Get used to the cold.

- “Restaurants have seen 2.1% job growth.. [however] such jobs – often with uncertain hour and few, if any benefits – aren’t attractive.” IMHO, attractive matters when you have a choice of jobs.

- “Middle-aged workers – who often have school-age children – are less flexible about relocating to find work in an another part of country.” Although you may not be flexible, children often are. Pack up and move. Children will find new friends in a new school. If the children don’t want to move, and can’t find new friends, maybe this is time for you to question why while standing near a mirror.

- “After a dozen of interviews in different parts of the country with no luck, Ms. F turned to contract-based consulting and says she has had fairly steady work ever since. ‘If I’d only looked for salaried positions I would have nothing on my resume for these last three years,’ said Ms. F.” Good for you! And because you know you can survive on your own, the relationship with your next employer will not be clouded by fears of unemployment.

Right to life, liberty, pursuit of happiness? Somewhere along the line, it became, “right to a job, no relocation (unless I want to, and then that’s my right), 2 cars, 3000 sq ft home, cell phones for all family members, benefits, and retirement.

I’ve moved across the nation more than a half-dozen times to pursue work. One time, I couldn’t sell a house and didn’t have a job. When a job across the nation was offered, the whole family moved. No, I did not default on the loan. I sold the house after 2 years of paying double mortgages. We did without. Another time I had to take a 50% cut in pay and landed in a situation where my expenses were 100% higher. Net result was I had to live on 25% of my prior income. When I did contracting work, I had no benefits, so I bought my own insurance or paid out of my pocket.

BTW, when did insurance become a plan to have everything paid for? Wasn’t it to insure against catastrophic problems? These days, we seem to be drifting to socialized coverage of everything. If you think the government will pay for it, ask yourself where the government gets money. They get money from you and from businesses. Where do businesses get money? They get money from you. Instead of looking for someone else to pay your bill with money laundered through multiple layers of beauracracy, I bet you could lower your policy premiums if you didn’t didn’t have such a low deductible and generous coverage.

What did I do in each of the situations my life presented? I cut back expenses until…(no magic here)…my spending was reduced to my revenue. It’s good to live light even between rough times, which allows you to save money to make the next rough time, well, ..less rough. The problem is, most people in America are loathe to cut anything they’ve become used to in bad times or good times. Said a different way, what I mean by “cut back expenses” includes the possibility that you DON’T get what you want, and that will give you good practice to restrain spending when you can get what you want.

I’ve decided it’s time that our nation should be confronted with default so our leaders are forced to spend money not to exceed revenue. We need to toughen up and realize that we cannot have everything we want.

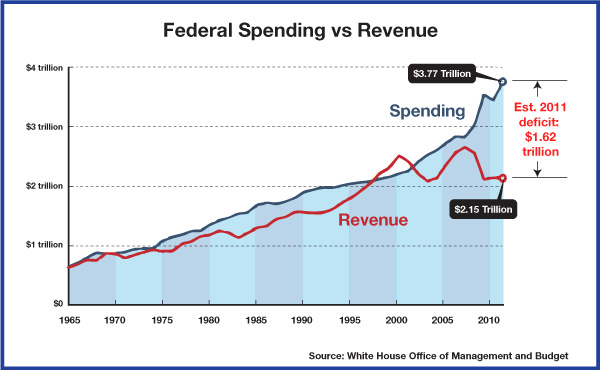

The above graph shows the deficit each year. That’s not cumulative debt. This shows the amount more we go into debt each year. And remember, we have to keep paying interest on last years’ debt, which makes next year’s problem even harder to get out of.

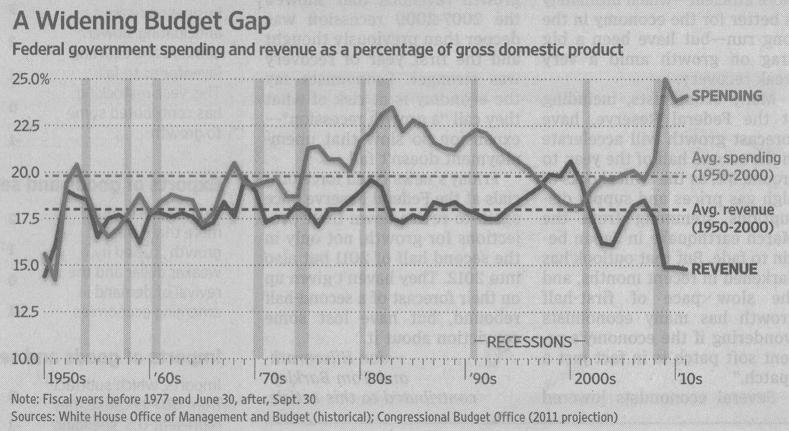

The graph below shows the same data as percentage of GDP. Looking on the far right of the graph, the government takes (revenue) about 15% of all the money earned by everybody in America. They spent at a level equal to about 24.5% of all the money earned by everybody in America.

99% of ICOs Will Fail

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency