I hear from multiple sources that to compare mutual funds, it is advantageous to compare returns and select funds with low expense ratios. This is false.

For example, a US News article by Kate Stalter gets it wrong and gives bad advise. Using the example at that page, if both funds return 5%, then it is irrelevant that one has a higher annual expense ratio because the return to you is identical, no matter how much fund managers were reimbursed behind the scenes.

This issue seems to come up a lot about index funds. For example, an Investopia article by Roger Wolner teaches incorrectly. Specifically, it speaks against a fund with a “whopping expense ratio of 1.07%” compared to others with an “expense ratio of 0.10%.” A link on that page about not paying high mutual fund fees confuses the issue between annual expense ratios, 12b-1 fees, operating expense, and account fees. The linked article continues with a discussion of what can make fees higher or lower (type of fund analysis, type of management, type of underlying assets, etc). It is misleading to blur the concept of fees with expense ratios. There are some fees taken after quoted returns, but this is not true for expense ratios.

Federal law requires mutual funds to report returns AFTER expense ratios are taken out. The daily price of the fund is reduced by these fees and then publicly reported. Similarly, the tabular return tables include returns after the expense ratios are taken out. There may be account fees that cause additional damage to you, but the underlying mutual funds are required to legally report returns after expense ratios. If you don’t believe me, call your mutual fund company and ask.

If you’re cruising Morning Star or a company website comparing tables of quoted returns, preferring funds because of low annual expense ratios is a red herring.

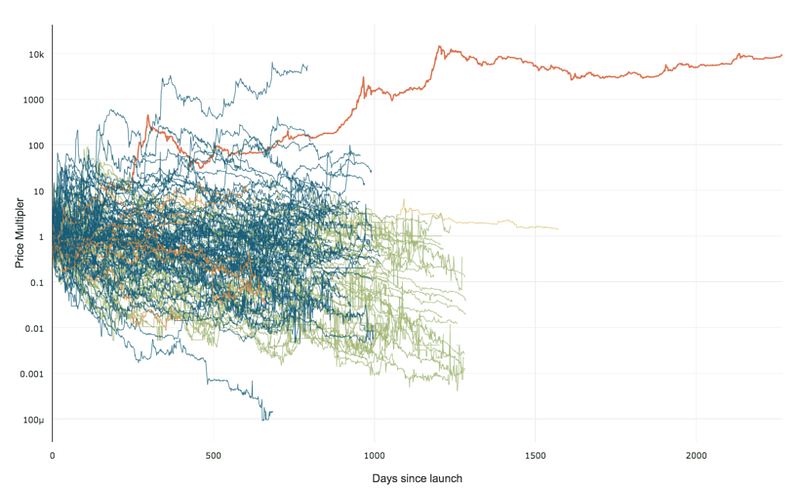

99% of ICOs Will Fail

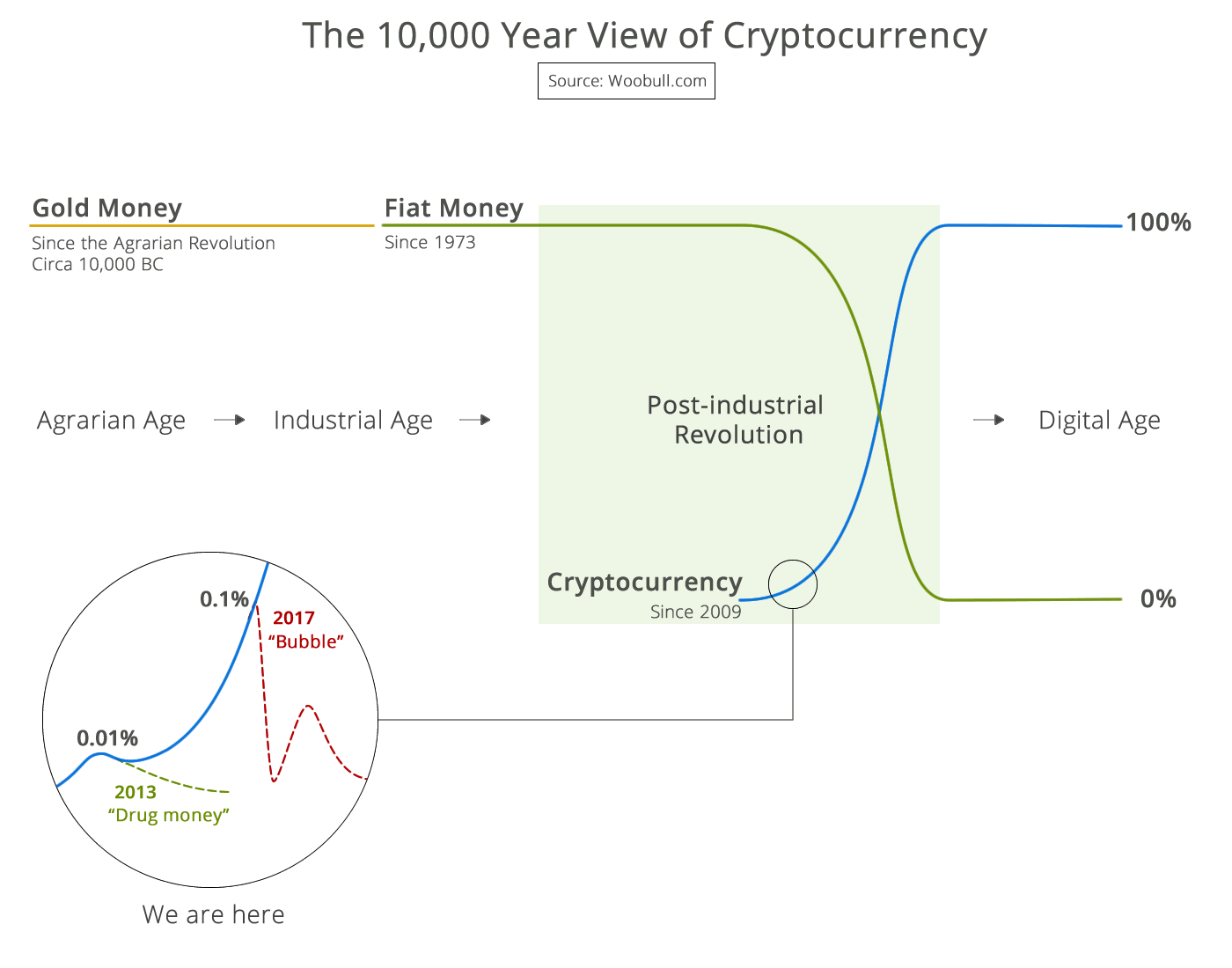

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency