Regarding John Norris’ weekend column “Debt isn’t all bad, but not understanding how to use it is,” I think he missed why many people believe debt is bad. He failed to address the real issue.

He cast the entire problem as a desire to make money, and highlights the profit difference between a for-sure 3.25% debt payment and a “should generate” 5-6% expectation. He fails to point out that the 5-6% earning is higher because of assumed risk. He summarized the analogy with “…take out loan all day long and twice on Sunday,” which is the attitude driving many people to suffer under huge debt loads.

Debt is not bad because it always looses a person money, so why did he write against that straw man argument? Please address the real issue debt is bad: nobody knows the future, and selling one’s life into bondage into the future for maybe gain is NOT freedom. As an American, I value freedom more than I value a few extra maybe dollars in my pocket.

America may benefit from huge indebtedness to other nations. For me, it is not worth the risk. Let’s just live on our own real-time productivity. Instead, we’re paying interest that is siphoning off a huge portion of what we could have used for other things. This ponzi scheme might work if everything keeps growing. But that’s a risk. It’s a risk that is not addressed in the article, and this risk is more foundational than the debate of what money should be spent on.

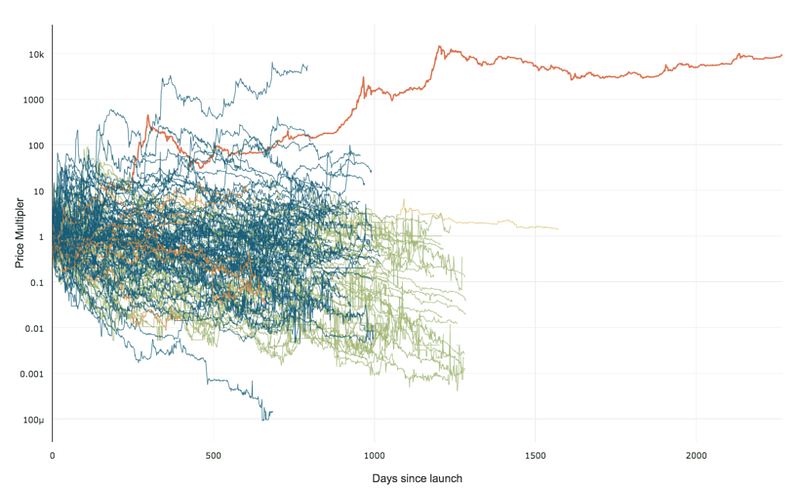

99% of ICOs Will Fail

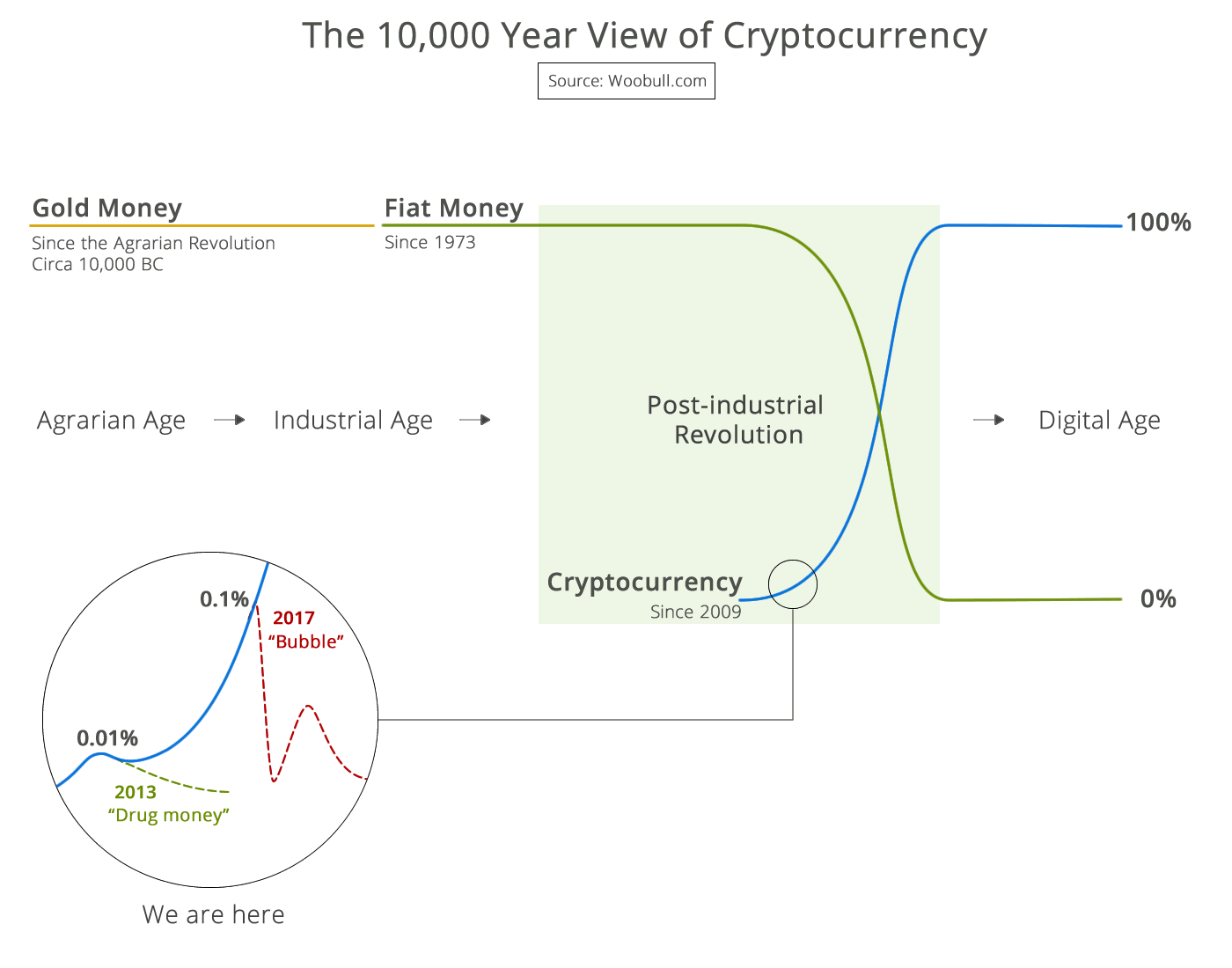

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency