In a prior post, I talked about taxing in a “fair” way, and this drew my attention toward another question. Should we tax income or assets?

This distinction between taxing assets and taxing income is often blurred by Americans. For example, it is at the heart of arguments being bantered around as the “Buffet Tax” concept. If a really rich person has no income (but a huge bank account), and his secretary does have income (and no bank account), how should each be taxed? Do we tax as a result of income, or as a result of assets?

It would seem any assets a person has, already arrived in the form of taxable income, so I prefer taxing income rather than assets if I have to choose. A person’s lifestyle also affects the conversion of income to assets. If I choose to live inexpensively with old cars and small house, I might accumulate more bank assets. However, that shouldn’t make my tax bill go up!

Taxing assets has other formulaic or practical problems, too. For instance, the yearly depreciation on your BMW is probably more than the value of my old car. So possibly, you would not pay taxes on way more than I even own!

Back in our nation’s history, we rebelled from British arostocracy, and it has been an anathema to give our government ability to tax assets. What our forefathers knew is that you can destroy people, families, and communities by doing such a thing. Our U.S. Constitution pretty clearly does NOT enumerate the power to tax a person’s estate.

Nonetheless, we now have estate taxes. Hmm..

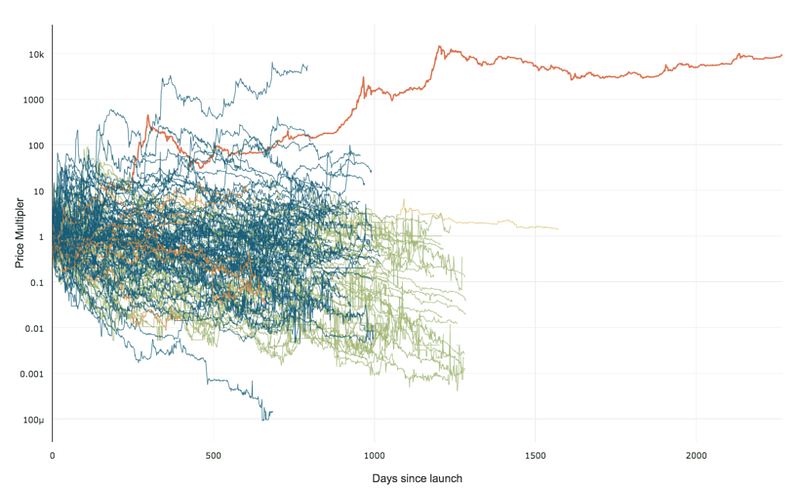

99% of ICOs Will Fail

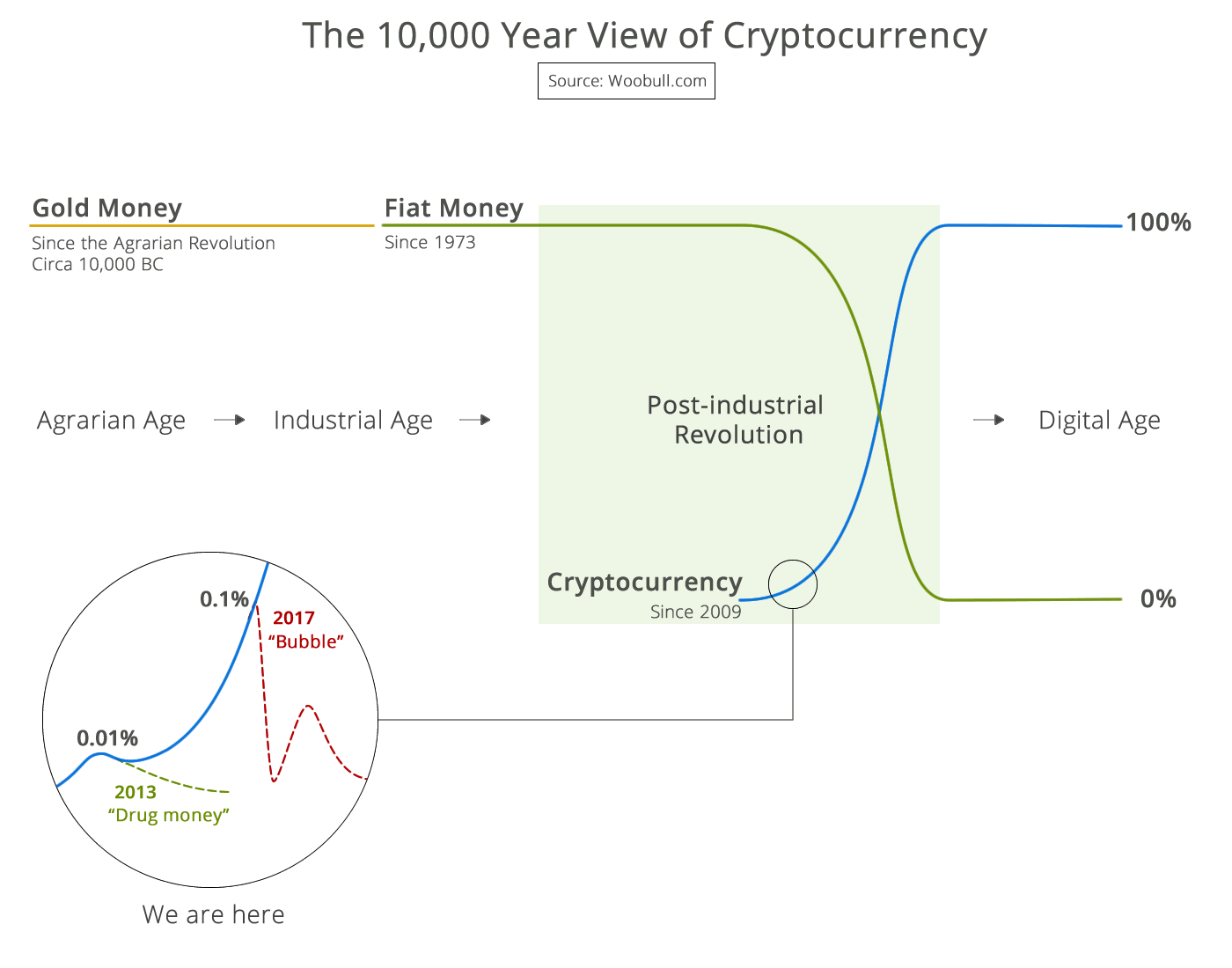

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency