“A Pivotal Trio: Stock Market, Dollar, and Gold”

Robert Wiedemer wrote recently about how gold is de-coupling from the Dow. What does this mean? His interpretation is that gold is finally being seen as a legitimate investment:

“Why is de-coupling so important for gold? Because it is graduation day for gold — the day it becomes viewed as an investment in its own right — an investment that goes up when the stock and bond markets go down and an investment that goes up even if other commodities go down. And it, when it is fully de-coupled it will be seen as a safe haven financial asset in turbulent financial markets and not as a commodity. As such, it will become an increasingly desirable investment.”

I read more into this decoupling. Think of the dollar, the Dow, and gold as a triad.

Typically, the American mind is grounded in dollars and therefore talks of the price of gold changing and the price of the Dow changing. Think broader. For example, physicists thought of mass moving around in space, and measured all this activity with time. Einstein was the first physicist to bring time into the mix as a peer parameter.

In terms of macroeconomics, American’s tend to think of dollars as their “electrical ground” – against which to measure all other financial movement. Others have been able to speak of gold as some sort of “true ground” against which to measure others. Perhaps it’s time to bring them all into the mix as peer parameters. Actually, this is the deletion of any absolute standard. Much to his chagrine, Einstein’s move matured 15 years later to remove any sense of causality from fundamental physics. The next big Economic theory will be to remove any sense of absolute.

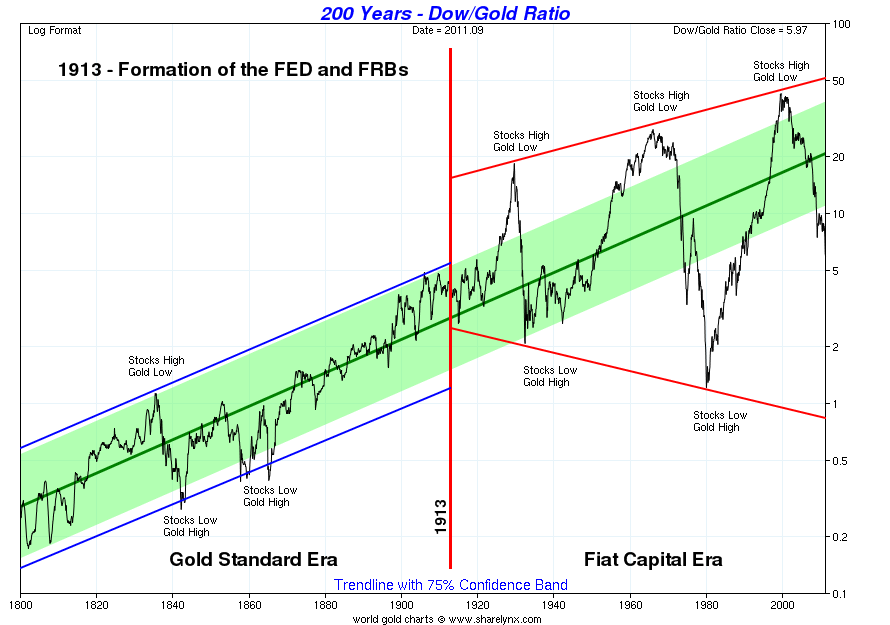

Since it’s inception in 1913, the American Federal Reserve bank has been chartered to control dollar stability and encourage employment. But when you have inherent oscillation in the system (such as the confidence and independence of each new population generation) in the psychology of a culture, ~something~ is going to oscillate. If the Fed Reserve won’t let the value of a dollar oscillate, something else will. Consider the differential between Dow and gold, specifically the Dow-to-gold ratio.

To the scientist, this type of “ratio plot” just a change of units: instead of “shares per dollar”, we shift to “shares per ozGold”. To the financier, I would propose to think of gold as the grounded value (instead of dollars) and consider how the Dow and dollar move against this new horizontal axes on the charts. Perhaps you’ll see some clarity in the above chart that is not visible on a Dow v. dollar or gold v. dollar chart. Do you see the oscillations?

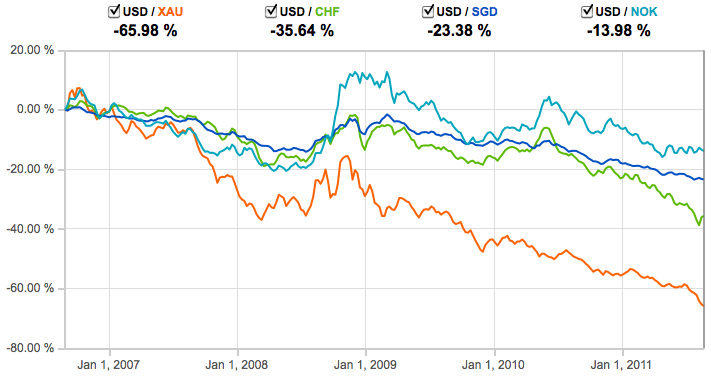

When gold and the S&P500 took a dive toward the end of 2008, what was really happening? In your mind, don’t think of everything in terms of dollars. Instead think of everything (including dollars) in terms of value. Using the oanda.com website helps find what was really happening:

Concomitant with the Dow taking a dive end of 2008, the dollar went up in value compared to the four currencies plotted above. When the dollar can buy more of all four currencies, instead of thinking only “the Dow went down” you should also think “the dollar value went up” (and so it took less dollars to buy a unit of the Dow or any of the currencies). Maybe the Dow did not go down in value as much as the dollar went up.

From 2009 through end of 2011, both Dow and gold drifted upward at similar slopes on a logarithmic graph – in other words, returns were similar against the dollar. Perhaps it was the dollar value decreasing. In fact, the Fed Reserve had the power to cause this, and did so, by driving down the value of the dollar. This is not their mistake. You need to understand that this is their purpose and intent. Whether or not this is driven by the political environment, you’ll have to decide on your own.

As I’m writing this, end of August of 2011, notice that the Dow is going down while gold is going up. Can a change in dollar value explain this? No. It is a shift of sentiment, and sentiment cannot be controlled by any fiscal or monetary policy of a nation. When the Dow and gold diverge or de-couple, what does this mean?

Maybe gold-Dow de-coupling is less about gold becoming a commodity traded investment and more about the dollar adjustments no longer have flex room. In other words, the Federal Reserve board cannot accomplish their goal anymore because their tools of increasing debt supply or money supply are maxed out. The dollar becomes a fixed pivotal value point that cannot move in value because the Federal Reserve that has no more power to move the dollar one way or the other with money supply or interest rate. The Dow and gold/other currencies behave like a teeter-totter around the dollar value.

Without an ability to move the dollar, exterior events will be free to “teeter the totter”, and oscillations will become prevalent. Rob Wiedemer often makes distinctions between oscillations and change. Both are possible. Look deeper into Control Theory of an Engineer’s world. There is often a mix of oscillations and change (monotonic movement). Using Mr. Wiedemer’s worlds, an oscillation getting larger and larger in amplitude is a change, rather than just an oscillation.

And so… what? Maybe a prediction. No, not a prophecy; just a prediction. The huge debt load will bear down on American culture, and the Dow to gold ratio is liable to depress down to about 0.75 by the year 2021. I’ve read about others predicting a $5000 gold price by 2019, which would imply a Dow of 3750. That’s a 65% drop from 10744 on 9/23/11. It looks like a pretty rough ride until about 2020.

99% of ICOs Will Fail

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency