[Complete text is at a new location: http://www.increa.com/articles/division-military-retirement-dual-coverture]

When dividing the marriage asset of military retirement pay due to divorce, the issues are superbly different than any other type of retirement. When dealing with normal civilian retirements, a coverture fraction method typically allocates what portion of a retirement was earned during the marriage, and then that portion is divided. Non-military retirements use time as proration measure individuals work contiguous days. Legally, this manifests as a “coverture fraction” that you are probably familiar with. An Active Duty military retirement is different because it is 2-dimensional. The retirement benefit is looked up in a 2-dimensional based pay table, using time of service and rank. These two factors are independent, and cannot be captured in one fraction. The coverture fraction is the result of two mathematical fractions multiplied together.

For military with a Reserve retirement (not an Active Duty retirement), duty points are used in the place of calendar time in the first coverture fraction because any period of calendar time may include a lot of duty or not very much duty. Like Active Duty, the coverture needs a second fraction based on rank.

…remainder of this blog entry moved to a new location: http://www.increa.com/articles/division-military-retirement-dual-coverture

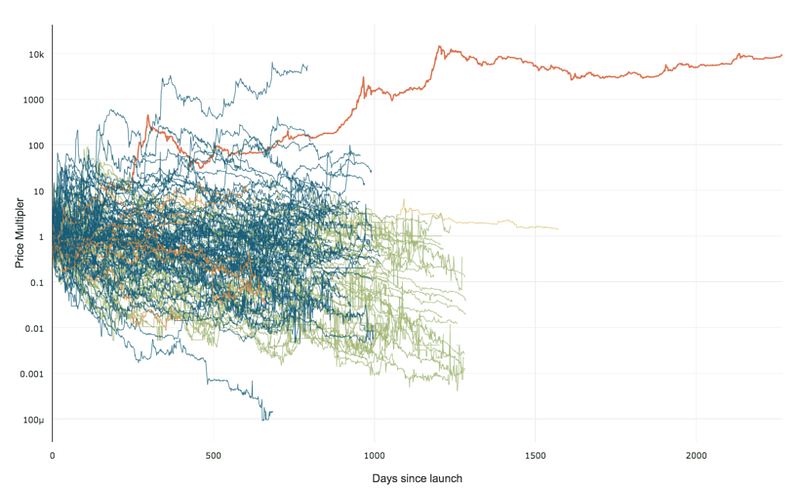

99% of ICOs Will Fail

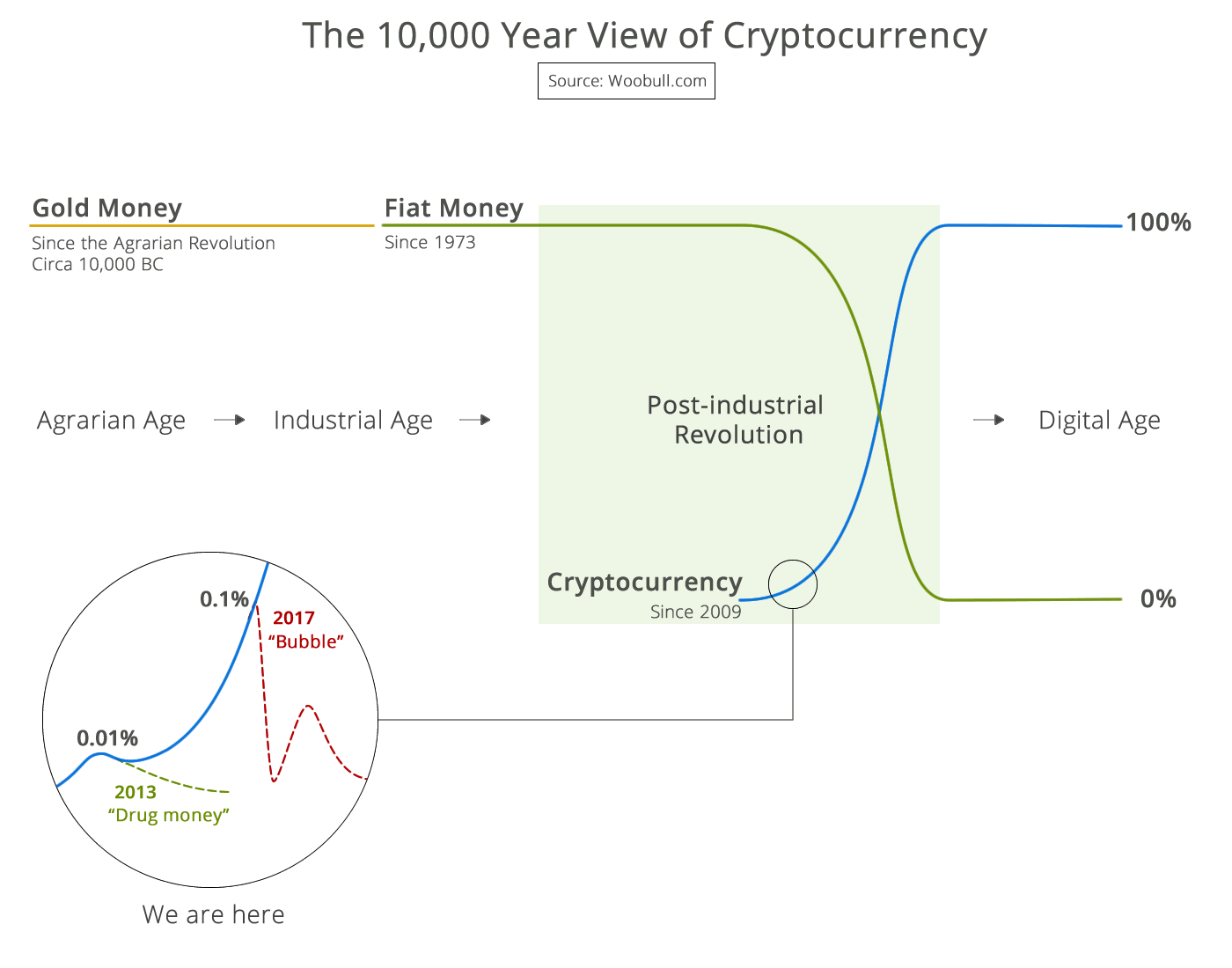

99% of ICOs Will Fail The 10,000 year view of cryptocurrency

The 10,000 year view of cryptocurrency